Credit Tightening Offers New Opportunities

Credit Availability Continues to Tighten

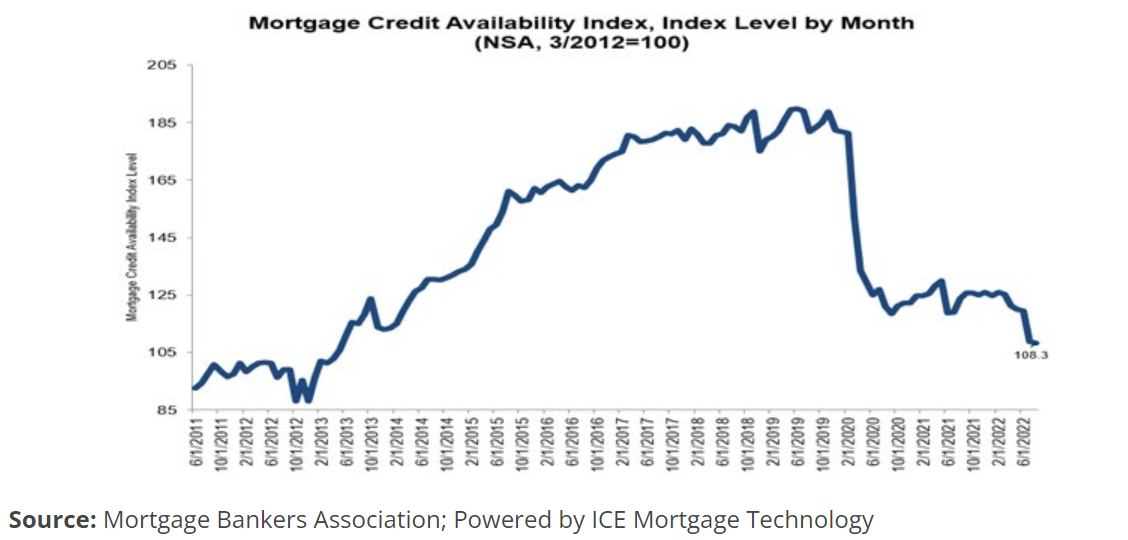

The opportunities for seller financing just keep improving. As reported in mymortgagemindset.com, the Mortgage Credit Availability Index (MCAI), mortgage credit availability decreased in August. The MCAI fell by 0.5 percent to 108.3 in August. This may not sound like a big change, but a decline in this index indicates that lenders are once again tightening their standards. What this means is that home sellers have an even greater opportunity to sell houses with financing to trustworthy home buyers who are being squeezed out of the market. Here’s a graphic that shows what has been going on with the MCIA since 2011:

Opportunities in Seller Financed Notes

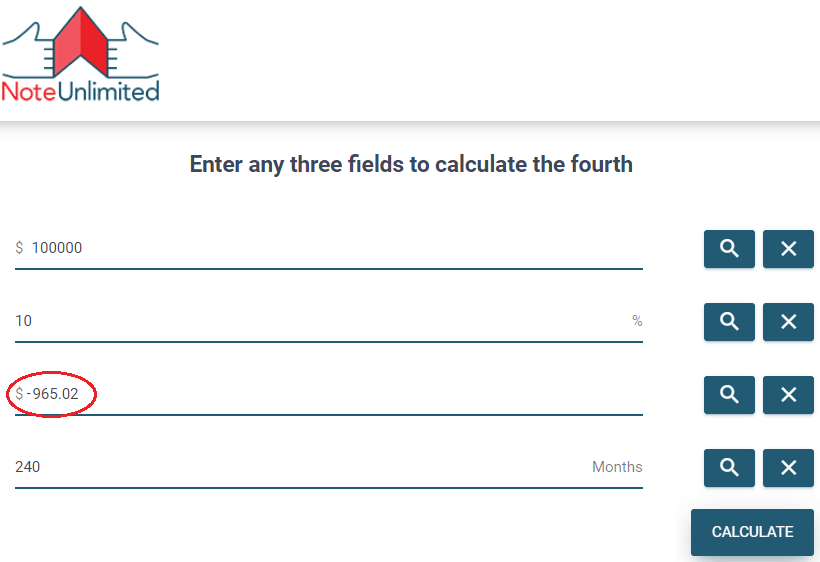

So what does this mean to the intrepid note buyer? Well, seller financed notes are a great way to get high yields on notes. Investors will often shoot for interest rates around 10%. Also, many of them like to get their money out as quickly as possible. They realize that selling an unseasoned note a steeper discount but they can make more money if they can keep finding deals and keep their money moving. Let’s say you found a performing, 20 year, $100,000 note at 10%. Using the free NoteUnlimited financial calculator, the payments would be calculated as follows:

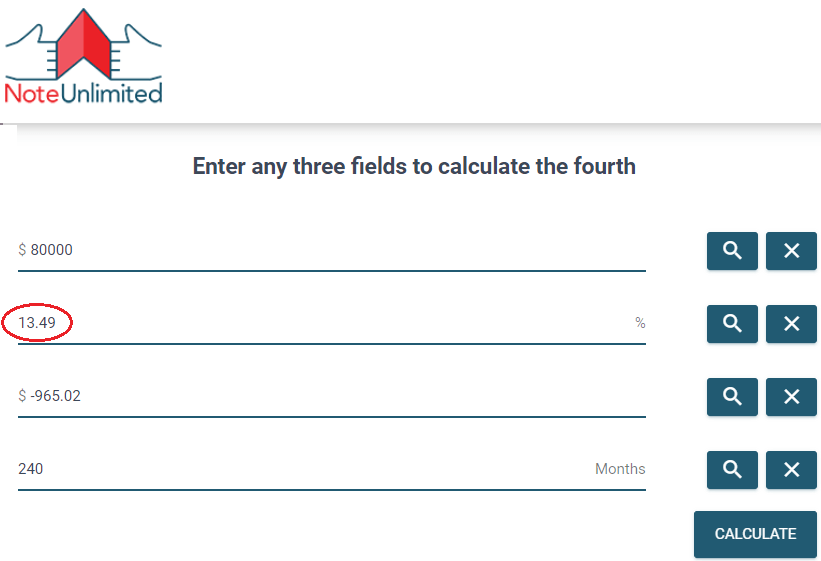

If you were then able to purchase it for 80% of face value, that would put your yield up to 13.5%.

Working with investors who offer seller financing is a great way to find performing (and sometimes non-performing) notes.

Finding Seller Financing Investors

So how do you find investors who are selling with seller financing? The best way is to network with other investors. When you meet investors who are selling with financing, ask them about their typical deals. Everybody loves talking about their own deals and they will generally tell you how much they need to leave in a deal finance it after they collect a down payment. Typically, they are leaving 40-60% of their money in the deal. You can ask them about how the recapitalize their businesses and see where the conversation goes. If your local REIA meeting allows you to make an announcement at the beginning of the meeting, you can make a short pitch to the room. Investors who are already using seller financing will immediately see the value in what you can offer. Even wholesalers in the room could get interesting in stepping in and creating passive income by working with you. As an educated note investor, you have a lot to offer to many real estate investors.

Growing and Managing your Portfolio

Don’t forget that NoteUnlimited is the premier package for managing and optimizing your note portfolio and for helping you streamline your due diligence process. Of course you can still use the free calculator available to anyone coming to our NoteUnlimited.com home page. Subscriptions are available for personal note investors and for full-up businesses. The Standard plan starts at $17/month and you can add additional notes as needed. Business plans are available for handling up to 250 notes/month.

For a 10% lifetime discount, enter the discount code Notes10GP when you start your subscription.

Blessing your success,

Gary Peyrot

NoteUnlimited user and contributor