Welcome to another insightful feature exploration on our Note Unlimited blog. Today, we’re diving into one of the most flexible and profitable tools in real estate financing—the wraparound mortgage. If you’re a real estate investor looking for innovative ways to finance properties, you won’t want to miss our latest tutorial. Watch our detailed video tutorial here.

What is a Wraparound Mortgage?

A wraparound mortgage, often simply called a “wrap note,” is a form of secondary financing for the purchase of real estate. The seller of the property extends a new mortgage to the buyer which encompasses both the remaining balance of the original mortgage and an additional amount that makes up the sale price. Unlike traditional financing methods, a wrap note enables the seller to become the lender, offering more flexible terms to the buyer while potentially increasing the seller’s income through interest rates.

How Does it Work?

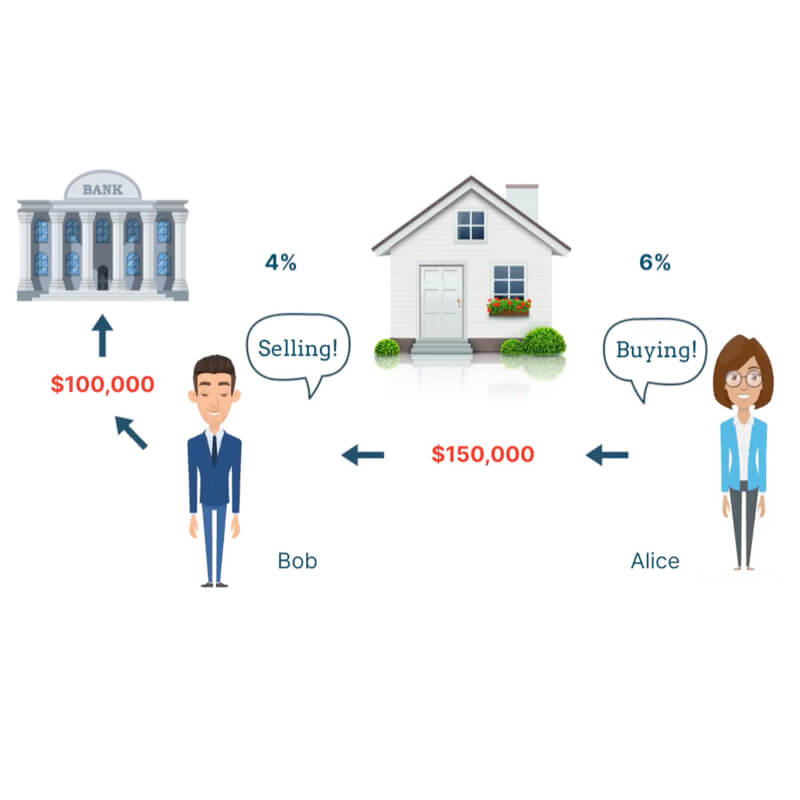

To illustrate, imagine a seller, Bob, who has a property priced at $150,000 with an existing mortgage of $100,000 at a 4% interest rate. The buyer, Alice, unable to secure traditional financing, agrees to a wraparound mortgage where she makes payments based on a $150,000 loan at a 6% interest rate. Bob continues to pay off the original mortgage but benefits from the higher rate charged on the new mortgage, creating an income opportunity through the difference in interest rates.

Managing Wraparound Mortgages with Note Unlimited

Note Unlimited simplifies the management of these complex transactions. Here’s how you can manage a wraparound mortgage using our tool:

- Create and Link Notes: Start by creating two notes under the same property address. Mark the first note as the ‘Wraparound Note’ to link it to the original mortgage.

- View Related Notes: Easily access details of both the original and wraparound mortgages under the ‘Related Notes’ tab. This provides a streamlined view of both agreements.

- Track Payments and Balances: The amortization tables and charts within Note Unlimited help visualize and track the payment schedules and remaining balances, making it simple to see how payments are applied over time.

- Analyzing Cash Flows and Equity: Our advanced interfaces allow you to view the cash flows, visualize monthly inflows and outflows, and analyze the equity growth and potential returns on your investment.

A Visual Journey Through Financial Growth

The Cash Flow tab within Note Unlimited now shows a clear graphical representation of your financial trajectory. From an initial positive cash balance, through the disbursement phase, and onto the gradual repayment phase, you can track every stage of your investment.

Long-term Financial Planning

The Investment Position tab integrates critical metrics like the Net Present Value (NPV), providing a snapshot of the investment’s viability and potential returns. This helps you make informed decisions based on the profitability of your investments over time.

Ready to Invest Smart with Wraparound Mortgages?

Wraparound mortgages can significantly enhance your investment strategy, providing flexible financing solutions and steady cash flow. With Note Unlimited, managing these complex transactions becomes straightforward, allowing you to focus on maximizing returns.

For a deeper understanding of how Note Unlimited can transform your real estate investment approach with wraparound mortgages, check out our full video tutorial: