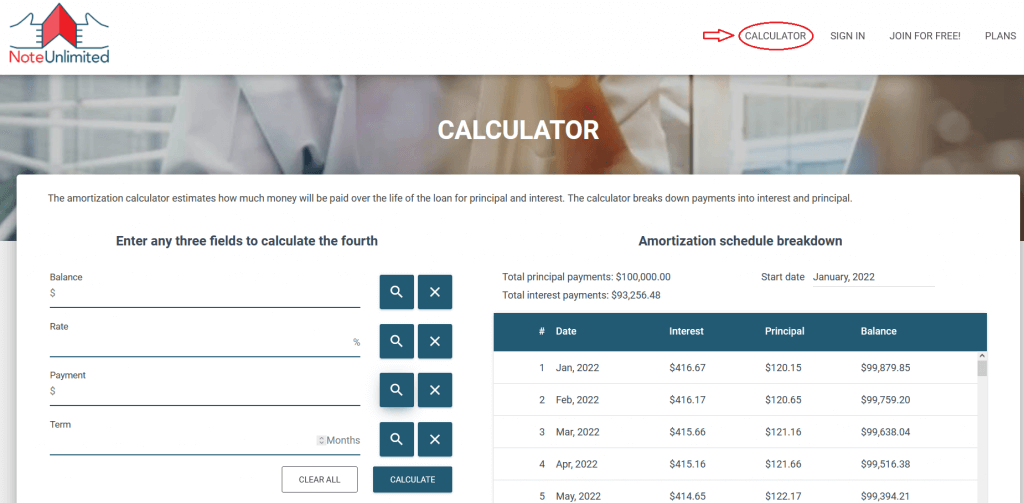

Using the Free Financial Calculator:

Financial calculators are very useful for calculating yields on notes. However, learning all the bells and whistles of an HP 10BII calculator can be fairly challenging.

That is why we developed one of the most popular features of our tool, the free-to-access financial calculator. It’s a simple 4-button app that let’s you figure out any of the four main features of a note given the other three. As you probably already know, these four most commonly used terms for notes are:

- Balance (or Present Value)

- (Interest) Rate

- (Monthly) Payment

- Term (in months)

So how would you use it? Well, let’s say that you found a seller who had created a note at 5% for 30 years on a $100,000 balance. 20 payments have been made on time and the exact payment required. You can easily figure this out using NoteUnlimited’s calculator app.

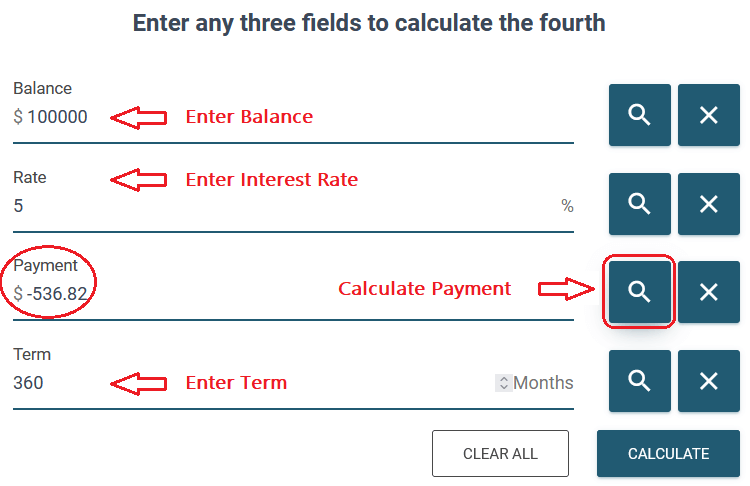

Checking the Payment:

First, you would want to calculate the payment for this note to see if the note was created properly. To solve for the payment, you have to enter the Balance ($100,000), Rate (5%), and the Term (360). Based on this, the payment can be calculated as shown below:

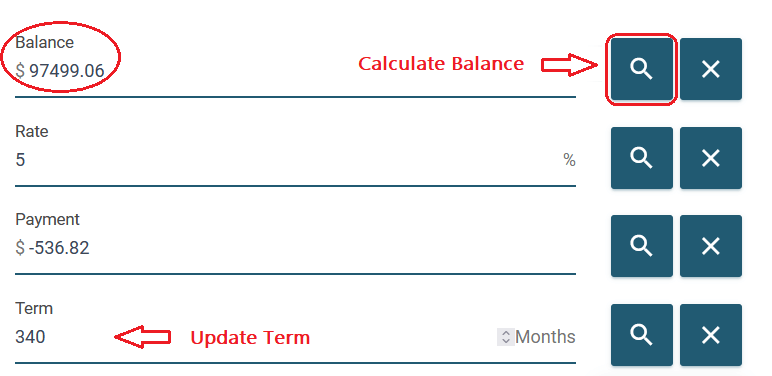

Calculating the Current Balance:

Then you would need to calculate the current balance after 20 payments (340 remaining). This shows that you should have a current balance of around $97,499 after 20 payments had been made.

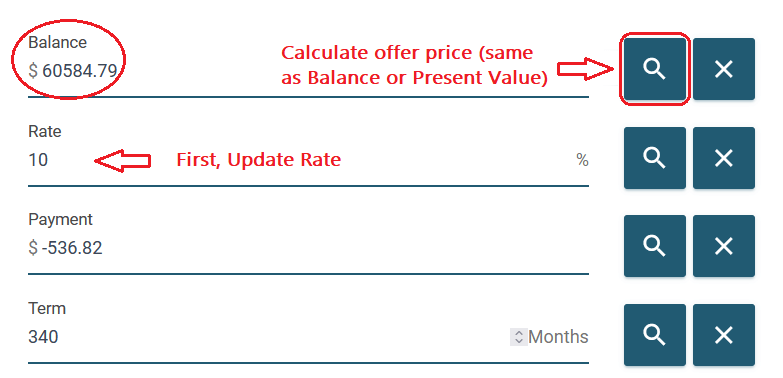

Calculating the Offer Price:

Then it is easy to calculate the price if you needed a 10% return. Just remember that the Balance of the loan is equivalent to the Present Value, which is the amount you would want to pay to get that 10% yield. The present value of that note at 10% is $60,584.79.

This means that the investor would need to sell you a $97.5K debt for only $60.6K if he wanted to satisfy your desire for a 10% return. Is that likely to happen? Well, it depends. It depends upon how badly he needs the $60K that you aer willing to offer. If that is going to allow him to close an important deal that will make him a lot of money, then he’ll probably go for it. And even if the seller wants to haggle about the discount, you can always ask him if he would rather keep the note and get the $537 a month or have the $60K now. If he needs the money, then he will probably take the deal. And in any case, you know exactly what to offer to get the return that you want. That’s a good thing!

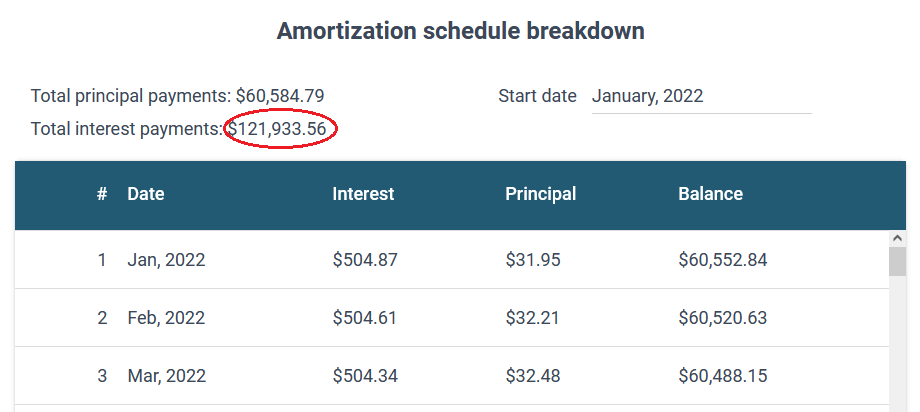

Looking at the Amortization Table:

Another nice feature is the amortization table. This shows a variety of factors pertaining to the loan. For one thing, you can see how much the loan will have been paid down out in the future. You can also see how much principal and interest are being paid. For example, if you wanted to figure out your taxable income over the life of the loan, you can easily get that from the amortization table. Since the interest is the only taxable part of the loan (the principal is just you getting your own money back), then the taxable income is equal to the interest that you expect to be paid on the loan. This could change if the borrower pays off early or if they pay more or less than the agreed upon amounts, but our calculator app generates an amortization schedule automatically which shows the interest paid on the loan, in this case, $121,933.56.

Bottom Line:

So using our free calculator app, you can quickly and easily calculate yields and other useful note parameters, without having to enter in all the property details for a note. This can help you make faster decisions and to close more deals. We all know that there is more competition for notes than ever before, and NoteUnlimited can help you move fast, with more accuracy, to close more profitable deals than ever before. I’m loving the features and hope you are too.

Don’t forget that, besides the free calculator app, you can get a free trial for our complete tool that will enhance and accelerate your note management and analysis, making it easy to pull the data and analyze it to make timely, accurate decisions.

Gary