So what’s happening these days and how is it going to affect active note buyers in the US market? That’s a great question with many people giving their opinions. I am no guru, so I will just share some fascinating data that I’ve found and then make some observations.

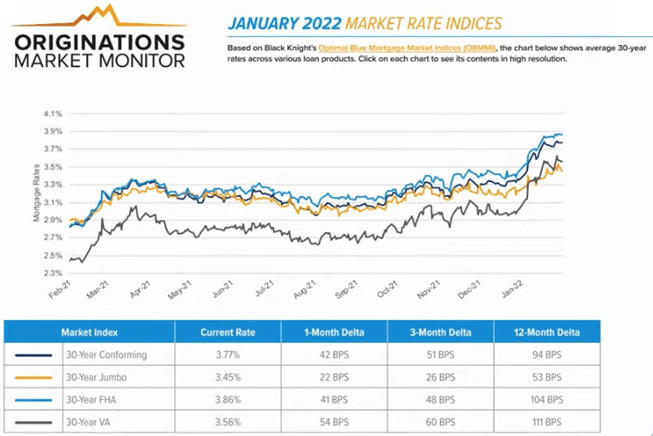

Mortgage Rates are Rising:

Despite rising mortgage rates and record-high prices, pending sales are still near last year’s record pace. Homes are selling in an average of only 29 days, down 10 days from just a year ago!

Inventories are still near record lows.

This causes many to believe that a slowdown is a long way off, despite the decrease in affordability.

Builders are having trouble finishing projects, so the inventory shortage may persist:

Housing Wire reports as of February 22 that supplies and pricing for a variety of building materials is still challenging and now worker availability is causing building prices to skyrocket and schedules to slip.

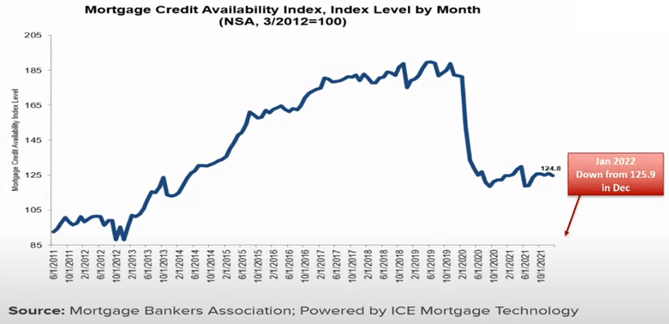

Credit availability is still a challenge, opening the opportunity for sales with seller financing:

Foreclosures are on the rise but still way below what would be considered normal:

Mortgage News Daily cites that foreclosure activity is spiking but is still far below what would be normal under these market conditions. The number of states with the largest increase in bank repossessions (REOs) compared to December were Michigan (up 622 percent); Georgia (163 percent); Texas (98 percent); Tennessee (50 percent); and Alabama (44 percent).

Performing notes continue to be in short supply, at least at acceptable yields.

A recent survey by the author on Paperstac revealed 86 performing assets and 97 non-performing assets. With all the foreclosure moratoriums and forbearance programs in place during the pandemic, we would expect to see the number of non-performing assets to increase dramatically over the next year.

Non-performing notes are beginning to become more available.

Eddie Speed on his Noteschool TV market update, shared that his research shows that there are over 2M loans that are considered shadow inventory.

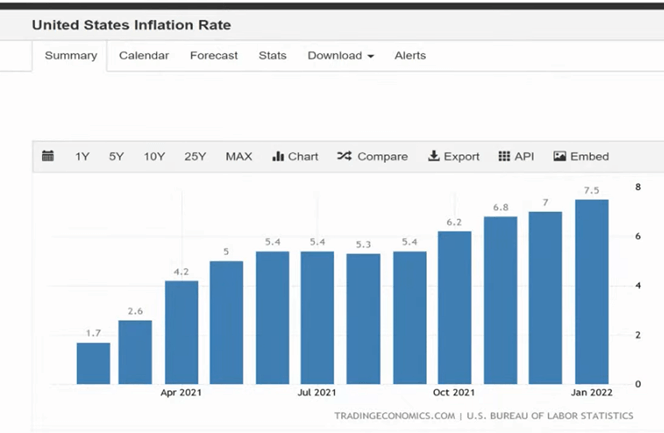

Inflation is climbing.

Getting a good yield on performing notes yield is as important as ever!

And many low income renters are struggling to pay their rents:

Bottom Line

All in all, these are still very interesting times. Note investors must continue to look for sources of performing notes without softening their standards and buying substandard products. You should probably consider keeping your power dry and being ready for when the dam breaks on the non-performing assets that were stopped up due to the pandemic.

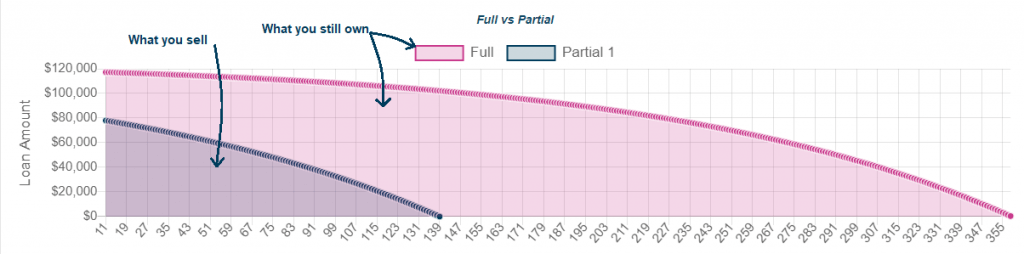

In the meantime, you may find opportunities by helping burned out landlords convert their rents to notes, affording them a truly passive income model. This can be used effectively when combined with an offer to the landlord to participate in the deal by buying a partial note. Structured properly, the note investor can get a higher yield on a small, front-end portion of the note, leaving the former landlord with the bulk of the payments. This eliminates the need for the note investor to charge a fee and keeps one free of the claim of offering legal advice on the deal.

And Don’t Forget:

We love using partials at NoteUnlimited. If you own a note and want to sell a portion of the payments to another investor, you can often recoup most or all of your investment by selling the partial note to a passive investor at a lower yield. Our NoteUnlimited tool models this easily. Here is a graph of a recent note that we analyzed:

Remember to log in today at NoteUnlimited.com for your free trial or to request a training webinar to find out how to use these simple but powerful tools to speed up your analysis, multiply your efficiency, and boost the performance of your note portfolio!

This is a great time to be a note investor. Don’t wait! Keep evaluating notes until you find the right one. Then find more. Let us know in the comments how we can help you.

Gary